The Changing Pharmaceutical Industry: (1) Physician engagement by utilizing more data

Michie Komoto, Healthcare Research Team

In this three-part series, we will discuss physician engagement. First, we will review customer engagement in the pharmaceutical industry today, which incorporates a wide range of data. Next, we will dive into the results from our survey on pharmaceutical companies’ ratings, specifically around lung cancer, and explore the differences between companies. Lastly, we will explain an approach to improve physician engagement with healthcare research.

(1) Physician engagement by utilizing more data

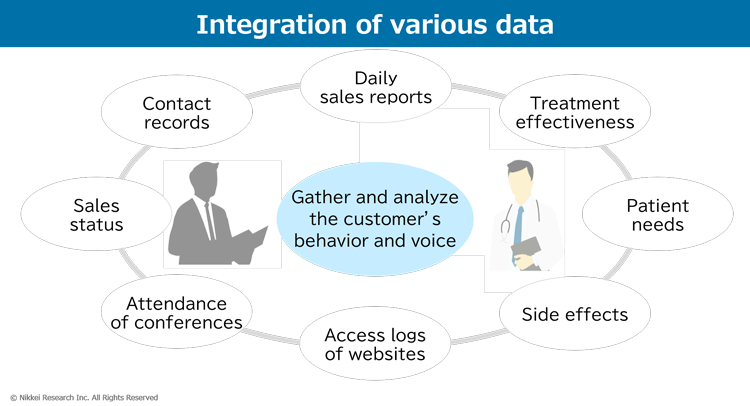

Alongside the wide spread of digital transformation, many pharmaceutical companies nowadays integrate various digitalized information, such as product information, sales status, information on physicians, and patient prescription data, into their internal operations and also use them for strategic planning. Between pharmaceutical companies and doctors, other than automatically stored data such as access logs of websites, information on the adopted treatments, patient needs, and side effects of drugs are recorded through daily sales reports or contact records by MRs (medical representatives) and MSs (marketing specialists) and analyzed. While data get rich and analysis advances, there are still some areas that pharmaceutical companies alone cannot grasp. It is difficult to understand the reasons behind them rather than the actions themselves. For example, what factors made doctors motivate that behavior, how significant the comparison was, and how they would make decisions in the future, etc. Those will not be able to be answered from just the information collected by MRs and MSs.

We believe drastic changes in the environment that doctors face are making it more difficult. First, physicians are constantly seeking accurate and up-to-date information for making a correct prescription with advanced new drugs. This is especially happening in the area of oncology, where doctors want to know about new developments all the time. They must constantly watch and gather information on products and manufacturers of not only what they are familiar with currently. Second, with the acceleration of digitalization, the means of gathering information are becoming more diverse. With the impact of COVID, the ways of approach to doctors by pharmaceutical companies became complex, both physical and online. Third, how companies are evaluated is turning to be more multi-perspective. As doctors are spending time with each patient much longer than in the past, the importance of supporting activities, disease awareness, and support throughout treatment and after recovery are increasing for pharmaceutical companies, besides only providing efficacious products. In this changing environment, it is necessary to look at the different perspectives and to understand the background of the behavior, rather than focusing on just the products’ ratings.

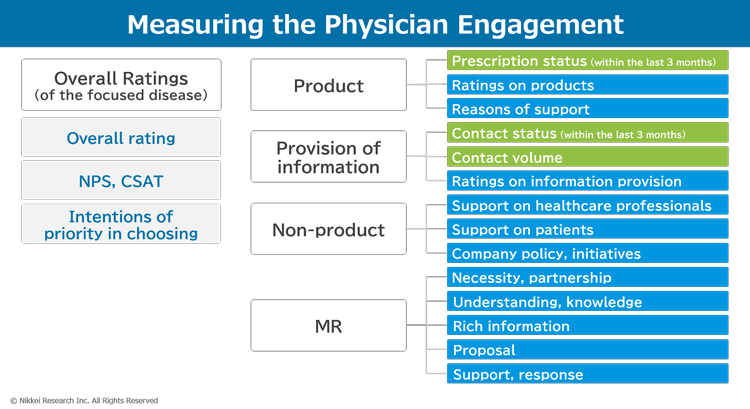

I think the future of physician engagement will be based on effective multifaceted analysis of customer feedback with internal data and supplement of external data, which pharmaceutical companies alone cannot fulfill. Nikkei Research collects external data and supports analysis, combining it with internal data regularly, and we believe abundant data and accurate analysis will help pharmaceutical companies to differentiate from competitors. Pharmaceutical companies have data such as the status of prescriptions (transaction records for the last three months), contact records, and the volume of contact activities. However, the status of other companies (i.e., prescribed volume, and contact activities) cannot be determined from internal data. Moreover, evaluation of competitors and themselves, such as several indicators of ratings from certain targets (KPI), like the following also lacks.

- Overall ratings, whether the company is supported

- NPS (Net Promoter Score), willingness to recommend

- CSAT (Customer Satisfaction)

- Intentions of priority in choosing

These metrics can be picked from what best suit the characteristics of the industry or the strategy of the company, and one does not necessarily have to implement all. For example, NPS and intentions of priority in choosing may be more appropriate than CSAT (overall satisfaction) for branded drug manufacturers, while CSAT may be more suitable for generic drug manufacturers.

please contact us below.