What Brands are Successful in the Multi-stakeholder Era?

Yasuko Watanbe and Shoko Fujikawa, Branding Solution Team

The Brand Strategy Survey is a proprietary service of Nikkei Research that visualizes the corporate brand strength of notable 600 companies in Japan, chosen from various industries. The 600 companies are evaluated by approximately 90,000 people nationwide in Japan. Conducted annually since 2003, with the latest survey held in 2022, it is the largest database of corporate brand surveys in Japan.

For more information on the survey design and measured items, please refer to the following link.

https://www.nikkei-r.co.jp/english/column/7656

Latest trends from the 2022 results

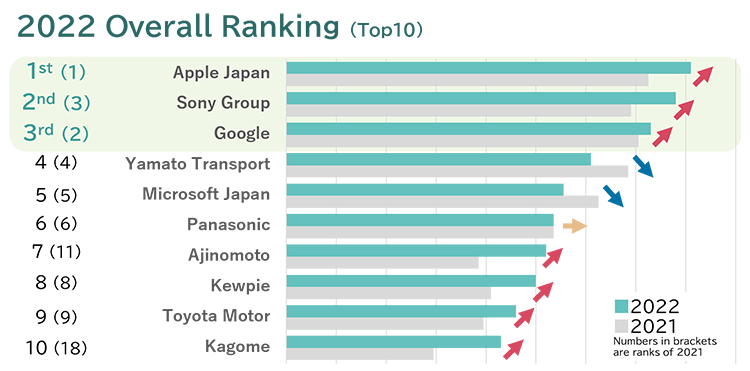

Looking at the top 10 in the overall ranking, one of the trends for this year is the growth seen in corporations that have promoted advanced business models, such as in mobility. Apple, with its Apple Car concept, ranked No.1 in the overall index (PQ) score for the fourth consecutive year, and its score has even increased from last year. Sony Group, which has partnered with Honda to launch an EV company, and Toyota Motor, which is developing hydrogen cars and smart cities, have also gained ratings since last year.

Another trend seen this year is the growth in scores for food and beverage companies. It appears that health-conscious products were welcomed due to the prolonged pandemic era and increased health consciousness. Last year, snack makers received high ratings from a slight luxury demand, but this year, "health consciousness" took over that trend.

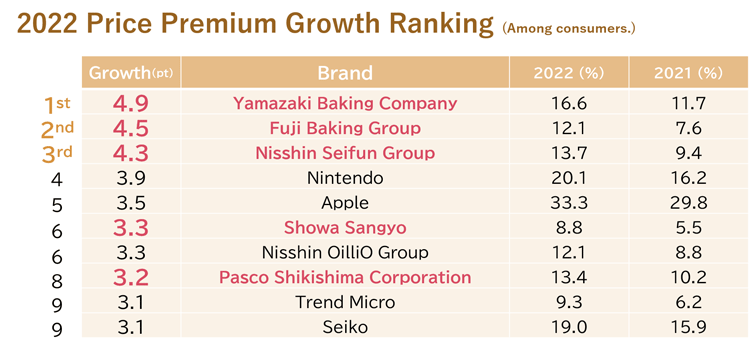

This year, the price of raw materials surged, and prices of various products hiked. “Price Premium” is one of the indicators used to measure price competitiveness in our Brand Strategy Survey. It is people’s willingness to buy a brand’s product/service even if the price is higher than that of others.

Looking at the 10 companies with the largest growth in scores of the “Price Premium” from last year, the top three companies were from the bread and flour industry: Yamazaki Baking, Fuji Baking, and Nisshin Seifun Group. Although the situation in Ukraine has caused wheat prices to soar and companies have taken steps to raise the prices of their products, the launch of high-value-added products and the detailed price tables have been received positively by consumers, and they are now willing to buy products even if they are much expensive than last year. Also, the 5th place, Apple, with a year-over-year score increase of 33.3 points, had the largest growth among all 600 companies. Even due to the price hike in Japan triggered by the difficulty in obtaining semiconductors and the weak yen, there is still a large volume of people who want to buy a new iPhone. We call this desire to buy even at a higher price, the "price premium," and is the core of brand power.

Brands that adapted over the changing times

Looking back over the past 20 years, we will examine the characteristics of companies that have responded to the changing times.

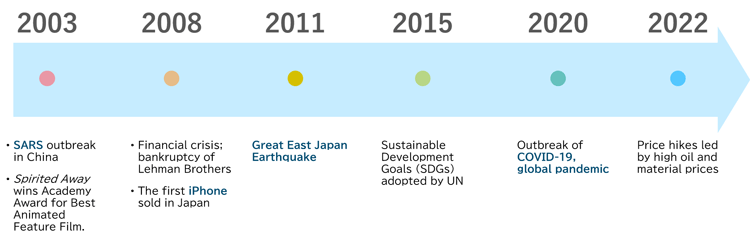

The year 2003, when this survey started, there was the SARS outbreak, and on the cultural side, the animation film Spirited Away won the Academy Award. 2008 was the year when iPhone was first sold in Japan. 2011 was the year of the unforgettable Great East Japan Earthquake. 2015 was the year when the Sustainable Development Goals (SDGs) were adopted by the United Nations. 2020 was, of course, the time when the world faced the new coronavirus pandemic, which still is continuously affecting many countries including Japan.

Watching the transition of the top 10 companies in the overall ranking, we can see that Google and Apple have been rapidly rising; Google since 2007 and Apple since 2012. Among Japanese companies, the Sony Group maintained a strong brand power, despite moving up and down over the years. Yamato Transport has also continued to be in the top 10 list.

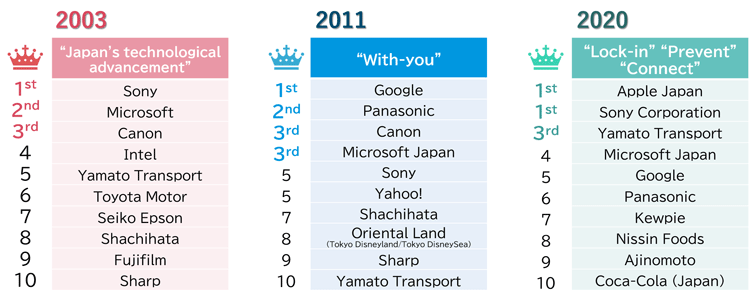

| 2003 | The first year, when we launched the Brand Strategy Survey. Looking at the overall index score, 6 out of 10 companies are from the "Electrical and Precision Machinery" industry, while 8 Japanese companies are in the top 10 list. This year’s top companies can be described as representing “Japan's technological advancement.” |

|---|---|

| 2011 | This is the year when the Great East Japan Earthquake happened. Companies of internet-related services (IT and e-commerce), such as Google and Yahoo, are in the top 10. The importance of the internet as a social infrastructure was recognized in the wake of the earthquake. Sharp had the top market share for cell phones in Japan at that time. It was around this time when Apple, not yet in the top 10, announced that they would be pulling away from personal computers. The status in the market is reflected in the brand rankings. Oriental Land (operator of Tokyo Disney Resorts) also had a difficult year, as it had to suspend operations due to the earthquake. However, it improved its reputation with its customer-focused crisis management; responding well at the moment when the earthquake struck, launching follow-up ticket policies, etc. Companies that achieved good ratings this year can be said to have the touch of “with-you”. |

| 2020 | The first year of COVID. Apple, Sony, and Yamato Transport were the top three. This year’s top performers responded well to demands of “lock-in,” “prevent,” and “connect.” Amidst the growing uncertainty, companies that were successful in delivering what makes time at-home more fulfilling, such as Apple and Sony. Or other companies that provided solutions such as making remote-work more efficient, better connecting with others, and protecting oneself and their family. |

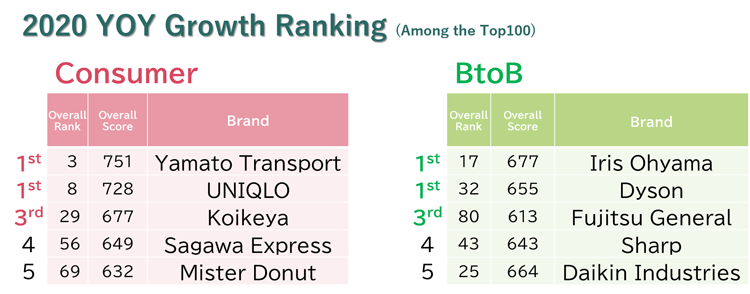

Both toward consumers and in BtoB, companies that have responded to the people’s demand saw a large increase in 2020 from the year before. Yamato Transport and Sagawa Express maintained operational providing mail-order services during people's "lock-in," Uniqlo and Iris Ohyama quickly started mask manufacturing, and Dyson and Fujitsu General responded to "prevent" (air purification).

Huge impacting events such as the 2011 earthquake and the 2020 pandemic have completely changed the mindset of people. Companies that quickly adapted and delivered the right needs gained good ratings, however, we saw companies that rose temporarily and then fall, which reminds us of the importance of a company's attitude of providing value continuously.

Brands that have grown over the past 20 years

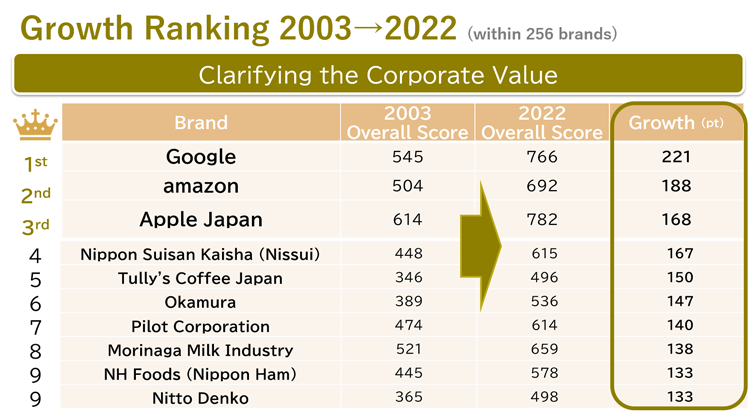

The top three companies that have the most increase in scores from 2003 to 2022, are Google, Amazon, and Apple. All are leading IT companies headquartered in the U.S. From the 4th to 10th places, there are many Japanese companies with a long history, across wide industries and customer characteristics. It can be said that those high performers are "clarifying the corporate value."

For example, Okamura, which ranked 6th, changed its name from Okamura Seisakusho to Okamura in 2018 and subsequently formulated the Okamura Way. In the Okamura Way, they have a declaration stating “Loving people, creating places”, where they aim to add values to places, rich in both material and spiritual wealth.

Pilot Corporation, in the 7th, is a 100+ years company with many revolutionary products by utilizing their technology — starting from its fountain pens to the Dr. Grip and FriXion. Being a company that “supports the art of writing” and under their purpose statement of “Our Creation Inspire Creativity,” Pilot Corporation has been delivering many innovative products.

Nitto Denko, ranked 9th, revised its logo and brand appearance to Nitto for showing the company's business expansion and for better communication with stakeholders, globally. Their brand slogan; “Innovation for Customers,” reflects the company's commitment to creating value in a customer-oriented manner.

Every top-performing company is refining its products by utilizing its own technology and know-how, while at the same time, successfully expressing and promoting those corporate values to stakeholders. After looking back over the past 20 years, we rediscovered that the corporate attitude has changed from branding that focuses on stimulating purchases but rather to appealing more on the value.

Empathy: Responding to the SDGs

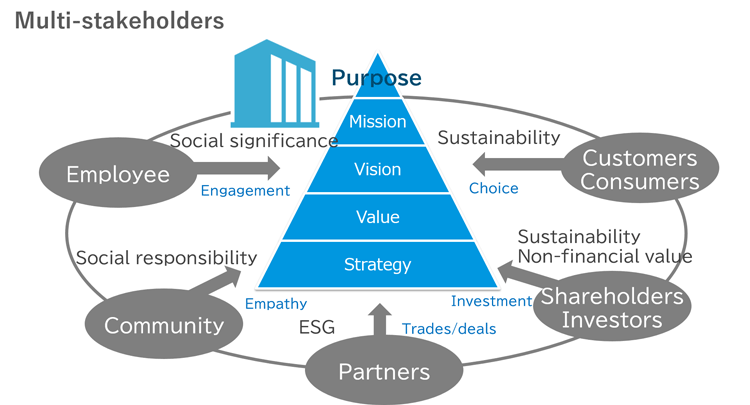

Today, when companies need to appeal their values to a wide range of stakeholders, what is becoming more important when thinking of strengthening brand equity?

When the value of the company is much more focused, communication with multi-stakeholders, to have them fully understand the company's value, is becoming a necessity. A good example would be the response to the SDGs, linked to corporate purposes.

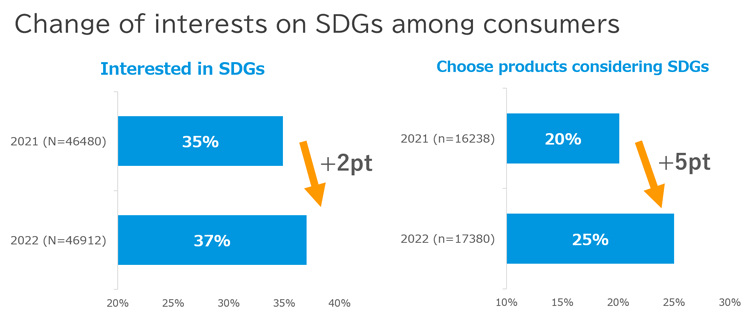

Consumers' level of interest in the SDGs, which was measured in the Brand Strategy Survey, increased by 2 points compared to last year, and the consideration of SDGs when purchasing products increased by 5 points. This indicates that the ways consumers look at companies are changing.

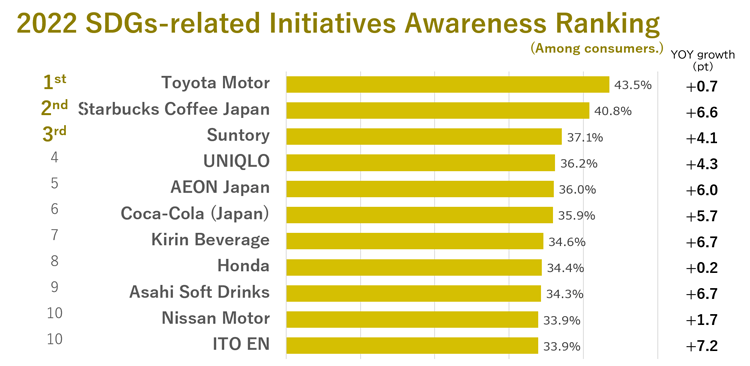

In terms of awareness of the company’s SDGs-related initiatives, both automobile companies and beverage companies dominate the top 10 list. In an open-ended question asking about the details of the initiatives, other than “hydrogen,” there were many mentioning “carbon neutral/decarbonization,” indicating the expectations are heightening toward automobile companies that are tackling climate change in the forefront.

The ratings of beverage companies promoting the “plastic ban” are rising. On the other hand, companies focusing on health science, such as developing “functional beverages,” are also gaining their rankings. The increase in awareness of the SDGs-related initiatives was seen across every company. We can say that consumers are paying more attention to the efforts of these companies.

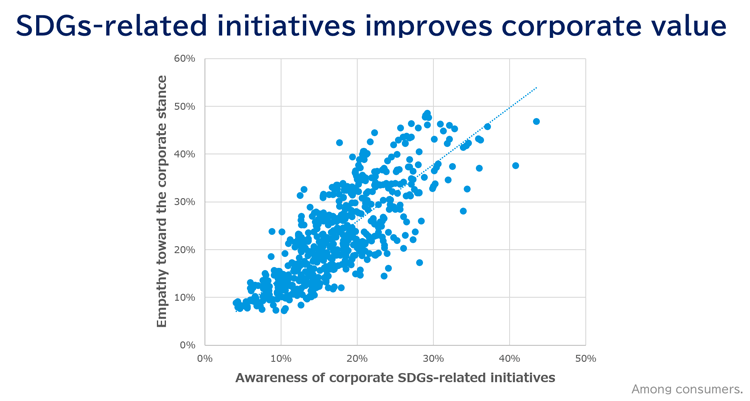

Mapping the 600 companies with the awareness of SDGs-related initiatives (horizontal axis) and the degree of empathy toward corporate stance (vertical axis), we can easily see that it has a correlation. We believe that empathy represents the strength of an entity’s raison d'être, and is an important indicator of brand equity.

Brand images that lead to empathy: Four factor groups

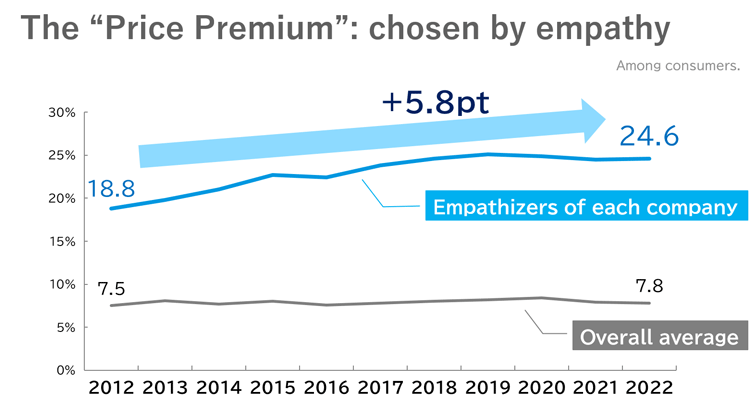

Empathy also affects a company's profitability. The “price premium” is an indicator of whether a company's products/services are worth buying even if they cost more than other companies. The overall average score is about 8%, and it has remained almost unchanged over the past 10 years. The average score for “empathizers of each company” has been increasing over the past 10 years.

So, what factors create empathy?

The content of empathy varies from company to company, depending on the industry, attitude toward business, and communication.

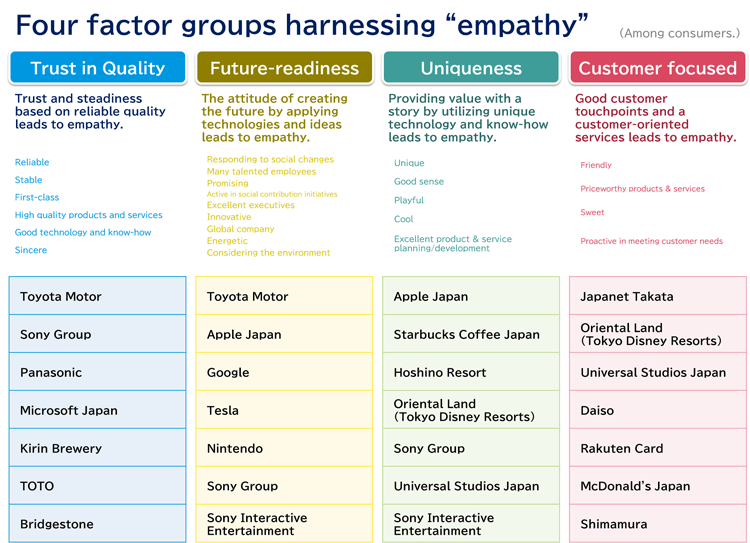

As a result of the factor analysis performed by the similarity coefficient (Jaccard index) between “empathy” and “brand image,” the following four factors were derived:

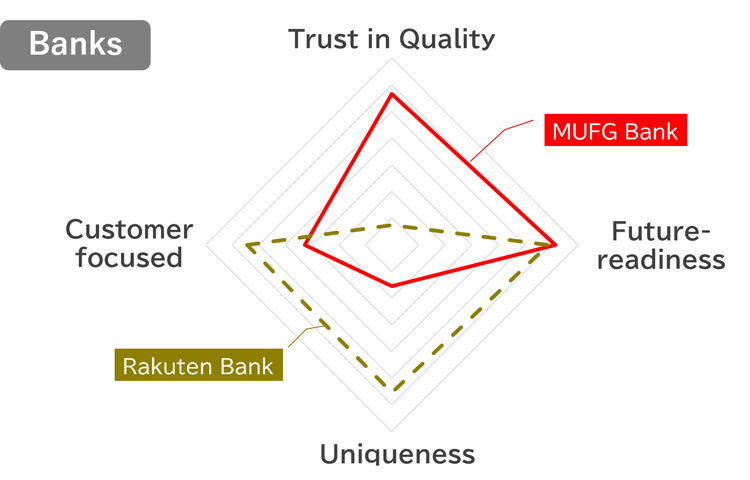

- The “Trust in Quality” group: characterized by “reliable,” “stable,” “high quality,” and “good technology”

- The “Future-readiness” group: with factors of “responding to social changes,” “many talented employees,” and “active in social contribution”

- The “Uniqueness” group: with characteristics such as “unique,” “good sense,” and “playfulness”

- The “Customer focused” group: represented by “friendly” and “proactive in meeting customer needs”

The “Trust in Quality” group is mainly composed of Japanese companies that provide reliable quality, such as Toyota, Sony, Panasonic, Bridgestone, etc. Based on those companies' high-quality, trust, and stability of the company lead to empathy.

The “Future-readiness” group has foreign companies such as Apple, Google, and Tesla. Japanese companies such as Toyota, Sony, Oriental Land, and others are also in this group. This group can be interpreted as pioneers that are leading to the future with their technological capabilities and ideas.

The “Uniqueness” group is across a wide range of industries, such as Apple, Starbucks, Hoshino Resort, Dyson, Yo-Ho Brewing, etc. They can be said to be companies who are “providing value with a story by utilizing unique technology and know-how leads to empathy.”

In the “Customer focused” group, Japanet Takata appears first in the list. Other companies are those with either physical stores/places or with strong customer touchpoints. Such as Oriental Land, Daiso, etc. Having strong customer touchpoints and customer-oriented service development leads to empathy.

Appealing to multi-stakeholders with your strong points

Even within the same industry, the characteristics of each company are recognized by consumers in different ways.

MUFG Bank is characterized by a relatively high “Trust in Quality” factor and a “Future-readiness” factor. These are the current advantages and strengths that MUFG Bank has in gaining “empathy.” On the other hand, Rakuten Bank, an online banking service provider, is characterized by a relatively high “Uniqueness” factor and a “Customer focused” factor.

By discovering these characteristics of each company, we can explore whether the company is successfully branding itself with those strong elements, or whether there are elements that are lacking that it would want to develop.

While a company promoting its business activities and raising its brand equity by gaining empathy from external stakeholders, the Brand Strategy Survey data can be used to (a) grasp the level of penetration, ratings, and change over time to check the outcome of communication activities, and (b) plan next actions by comparing with competitors or benchmark companies from the data of 600 companies.

Our solutions for branding

Nikkei Research's framework can be applied to any external audits, customized brand surveys, and related analytics services. We can also conduct internal audits targeting employees, that can be used to understand the level of internal brand penetration, operational bottlenecks, and internal communication issues in the company. The framework can also be applied to global surveys across multi-countries.

please contact us below.