Half of the Elderly, Not Taking Advice from Financial Institutions and Making Decisions On Their Own

From the latest results of the Nikkei Research’s Japan Financial Institution Customer Ratings METER®, we analyzed the consumers’ intentions toward investment products, life insurances, non-life insurances, over the sources of consultation by each phase of the buying process, there was significant behavioral differences in the information search phase by age group. The analysis indicated that financial institutions need to take more attention to the characteristics of each age group and engage with them separately.

Where people seek for consultations over financial products

In this survey, respondents were asked where they had consultation in each of the following phases: (1) information search, (2) alternatives evaluation, and (3) product review, for investment products, life insurance, and non-life insurance.

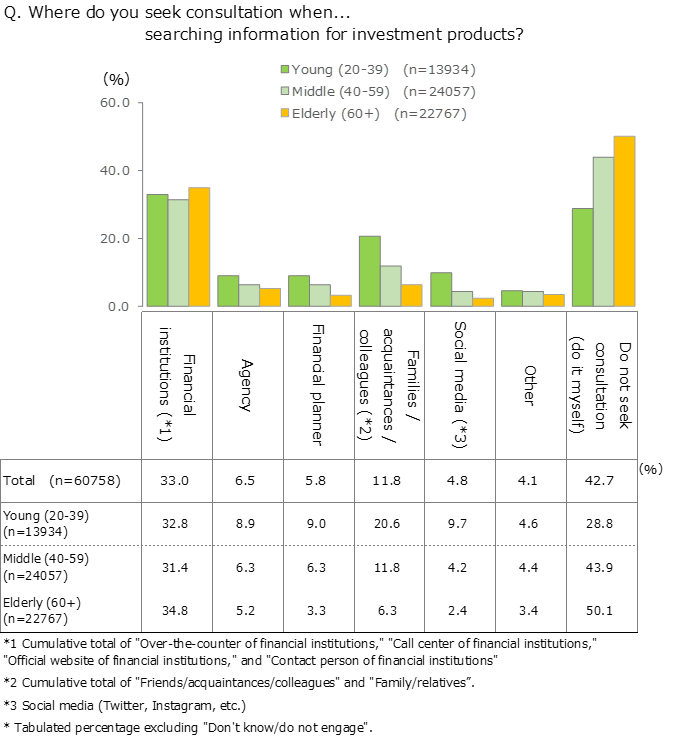

In the case of investment products (Figure. 1), 42.7% of the total respondents chose "Do not seek consultation (do it myself)," and only about 30% had been consulted by financial institutions. The shares of whom do not seek consultation tends to increase as higher the age level. Especially, half of the respondents in the elderly (over 60 years old) do not seek consultation and do it by themselves. On the other hand, 20.6% of the younger group (20-39 years old) seek advice from closer relations such as family members or acquaintances, and they greatly depend on social media compared to other age groups.

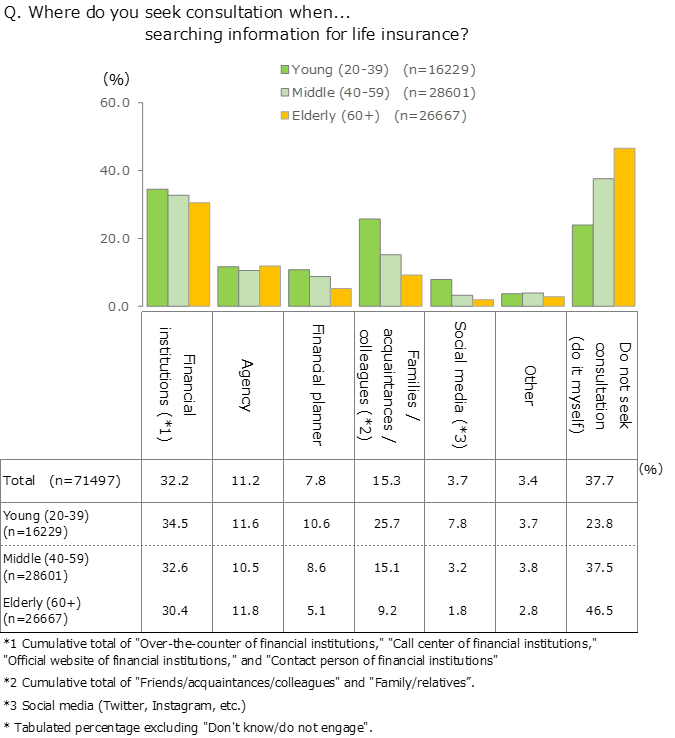

Similar trend as investment products were seen in the information search on life insurance (Figure. 2), with 37.7% of the total respondents choosing "Do not seek consultation (do it myself)" as the highest. In younger age groups, 25.7% seek advice from family members or acquaintances, and relatively low 23.8% do not seek consultation (do it myself).

The percentage of those who do not seek consultation increases with age can be explained by the financial literacy -- as the older they are the more experience and knowledge they have in investing. Also, they will have more time to spend on information search on their own and would be able to make decisions without relying on financial institutions. In contrast, the younger generation seems to be seeking advice from a wide range of sources, such as people close to them, social medias, and financial institutions.

In the midst of flooding information today, consumers have more options on where to seek advice, than ever. The keys are to (1) provide an attractive platform and valuable information for those who do not seek consultation but are doing it on their own, and (2) create an environment and provide services that help make younger generations who are new to finance easier to seek consultation. Financial institutions will need appropriate measures based on the characteristics of each age group to be continuously chosen as the top consideration.

-

Jan/17/2022

Nikkei Research’s Japan Financial Institution Customer Ratings METER® includes the detailed results by each individual financial institution. It can be used as an essential data upon considering how to engage with your target audiences and plan effective promotions.

Please contact us if you are interested in further details.

please contact us below.